Prepare and file any necessary tax returns on behalf of the deceased

CM Law's Ultimate List: The top 50 FAQs on Administration of Estates #14: File Tax Returns

How to Lodge Returns for a Deceased Estate: A Step-by-Step Guide

When a loved one passes away, managing their estate can be a daunting task, especially when it comes to understanding the tax obligations involved. One critical aspect of this process is lodging tax returns for the deceased estate. This guide will walk you through the key steps, including when a trust tax return is required, how to obtain a Tax File Number (TFN) and an Australian Business Number (ABN) for the estate, and how to correctly lodge the return.

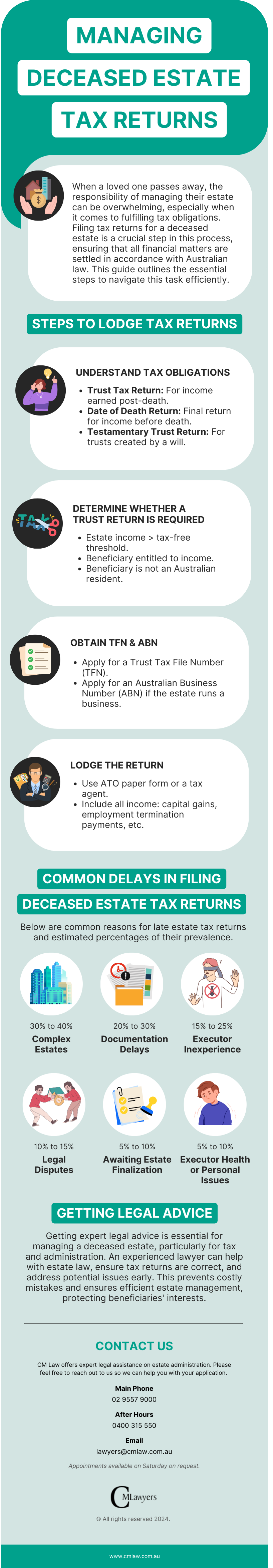

Below is an infographic for a brief overview of managing deceased estate tax returns. For a deeper understanding of the topic, check out our detailed article below the infographic.

What is a Trust Tax Return?

In Australia, there are no inheritance taxes, but the estate may still have tax obligations. A trust tax return is used to report the income generated by the deceased’s estate after their death, such as rental income or share dividends. It also allows the estate to claim any tax refunds or franking credits owed. If a return needs to be lodged, the estate is treated as a trust for tax purposes. Trust tax returns may need to be lodged annually until the estate is fully administered.

This differs from:

- The date of death tax return: which covers the period before the deceased’s death.

- Testamentary trust tax returns: which are separate trusts created under the terms of a will and continue after the estate is finalized.

Who Can Lodge a Trust Tax Return?

Typically, the authorised legal personal representative (LPR) of the deceased lodges the trust tax return. You can lodge a return once you’ve notified the Australian Taxation Office (ATO) of the death, and they have recognized you as the person managing the deceased’s tax affairs. If you're not the authorised LPR, the ATO will assess the lodged returns according to the law and their internal policies.

When is a Trust Tax Return Required?

For the first three income years after the deceased’s death, you must lodge a trust tax return if:

- The estate’s net income exceeds the individual tax-free threshold.

- A beneficiary is entitled to any of the estate's income at the end of the year.

- A beneficiary of the estate is not an Australian tax resident.

From the fourth income year onwards, a trust tax return must be lodged if the estate earns any income, including capital gains. Even if not required, you may choose to lodge a return, for example, to claim franking credits on dividends paid to the estate.

Example of Lodging Tax Returns for a Deceased Estate

Consider the case of Maree, who passed away on 4 March 2024. Her son Zach, as the authorised LPR, is responsible for lodging the tax returns.

- Individual Tax Return: Zach lodges a final individual tax return for Maree, covering income from 1 July 2023 to 4 March 2024.

- Deceased Estate Trust Tax Returns: For Maree’s estate:

- Income Year 1 (5 March 2024 to 30 June 2024): The estate earned $9,500, below the tax-free threshold, so no trust tax return is required.

- Income Year 2 (1 July 2024 to 30 June 2025): The estate earned $30,000, above the tax-free threshold, so a trust tax return is lodged.

- Income Year 3 (1 July 2025 to 30 June 2026): The estate is finalised on 31 August 2025. Despite earning $5,000 (below the threshold), Zach lodges a trust tax return because there are presently entitled beneficiaries.

Getting a TFN and ABN for a Deceased Estate

To lodge a trust tax return, the estate needs a trust TFN. If the deceased estate is running a business, an ABN is also required.

- If the estate is not running a business: Apply for the trust TFN online through the Australian Business Register. The authorised LPR or their representative usually applies for the TFN.

- If the estate is running a business: The LPR must apply for a new ABN, as the existing ABN cannot be used. Both the TFN and ABN can be applied for simultaneously online.

Lodging a Trust Tax Return

You can lodge a trust tax return using the paper form available from the ATO. If you’ve appointed a tax agent, they can prepare and lodge the return online on your behalf.

Income to Include in a Trust Tax Return

When preparing a trust tax return, include all income the deceased estate has earned since the date of death, such as:

- Capital Gains: If an asset is sold or transferred (not under the will or succession rules), include any capital gain or loss.

- Employment Termination Payments (ETP): Report any death benefit ETP received by the estate, as it is taxed similarly to payments made to beneficiaries.

If a capital asset passes to a beneficiary, the capital gain or loss is not included in the trust tax return, unless the beneficiary is a foreign resident, charity, or super fund.

Case Study: Costly Tax Mismanagement in an NSW Estate

Case Overview

In the case of Re Estate of Thompson [2021] NSWSC 1120, the executor was accused of failing to properly manage the estate's tax obligations, resulting in substantial financial losses. The estate comprised a family home valued at $2 million, a commercial property worth $1.2 million, and a diversified portfolio of shares and bonds valued at $800,000. The executor's mishandling of tax returns led to significant penalties and interest charges, diminishing the estate's value.

Behavior of the Participants

The executor, a close relative of the deceased, initially appeared diligent in managing the estate. However, due to a lack of understanding of complex tax regulations, they delayed filing the required tax returns. This delay caused anxiety among the beneficiaries, who feared that the estate might become insolvent due to accumulating penalties and interest charges.

As the months passed, the executor became overwhelmed by the mounting paperwork and ceased communicating with the beneficiaries. Desperate for answers, the beneficiaries sought legal counsel, hoping to prevent further damage to the estate. Tensions reached a boiling point when the ATO issued a notice of intent to levy additional penalties due to non-compliance, leaving the beneficiaries in a state of panic and uncertainty.

Legal Process and Court Involvement

The beneficiaries filed a formal complaint with the NSW Supreme Court, requesting the removal of the executor due to mismanagement of tax obligations. The court examined evidence of the executor’s failure to file the final income tax return, resulting in penalties of over $100,000. Additionally, the court found that the executor did not properly account for capital gains tax liabilities arising from the sale of the commercial property, leading to further financial consequences for the estate.

Financial Consequences

The estate faced severe financial repercussions due to the mismanagement of taxes. The delay in filing the necessary tax returns resulted in fines and interest charges totaling $150,000. The sale of the commercial property triggered unexpected CGT liabilities amounting to $200,000, significantly reducing the value of the estate. The legal fees associated with the court proceedings reached $120,000, further diminishing the inheritance available to beneficiaries.

Lessons Learned

- Understand Tax Obligations: Executors must be aware of all tax liabilities and ensure timely filing to avoid penalties.

- Seek Professional Advice: Complex tax matters may require the expertise of a tax professional to ensure compliance with Australian laws.

- Maintain Clear Communication: Executors should keep beneficiaries informed about the estate's tax status to avoid misunderstandings and disputes.

Common Reasons for Late Estate Tax Returns and Their Estimated Percentages

Managing a deceased estate can be a complex and challenging process, and it’s not uncommon for estate tax returns to be lodged late. Various factors contribute to these delays, each with its own impact on the timeline. Below, we outline the most common reasons for late estate tax returns and provide estimated percentages to illustrate their prevalence:

- Complexity of the Estate (30-40%): Estates with multiple assets, business interests, or international components can be difficult to manage. The intricate nature of these estates often leads to delays in filing tax returns, as the executor must navigate numerous legal and financial obligations.

- Delays in Obtaining Documentation (20-30%): Executors often face challenges in gathering all necessary documents, such as financial records, valuations, and details of the deceased’s income and assets. This is particularly true for larger estates or those with dispersed assets, where tracking down every required document can take considerable time.

- Executor Inexperience or Lack of Awareness (15-25%): Executors may not be fully aware of their obligations or the timelines for filing tax returns. If they are unfamiliar with the process or do not seek professional advice, this can lead to significant delays in meeting tax filing deadlines.

- Legal Disputes (10-15%): Disputes among beneficiaries or challenges to the will can delay the finalization of the estate. These legal complications often slow down the entire probate process, including the filing of tax returns, as the resolution of disputes is often necessary before proceeding with tax matters.

- Awaiting Finalization of the Estate (5-10%): Some executors choose to wait until the estate is fully administered before lodging tax returns. While this may seem logical, it can result in late filings, especially if the process of finalizing the estate takes longer than anticipated.

- Health or Personal Issues of the Executor (5-10%): Personal circumstances, such as illness or other life events, can also contribute to delays in filing estate tax returns. If the executor is facing personal challenges, it can become difficult to stay on top of the estate’s administrative tasks, including timely tax return lodgment.

These percentages are rough estimates based on typical scenarios encountered during estate administration. The actual distribution of reasons for late estate tax returns can vary depending on the specific circumstances of each estate. Understanding these factors can help executors take proactive steps to avoid delays and ensure that all tax obligations are met in a timely manner.

References:

Government Resources

- Australian Taxation Office – Deceased Estates

URL: https://www.ato.gov.au/Individuals/Deceased-estates - NSW Government – Wills, Probate, and Inheritance

URL: https://www.nsw.gov.au/law-and-justice/wills-probate-and-inheritance - NSW Supreme Court – Probate

URL: https://www.supremecourt.justice.nsw.gov.au/Pages/sco2_probate/probate.aspx - Revenue NSW – Estate Duty Information

URL: https://www.revenue.nsw.gov.au/taxes/estate-duty - NSW Trustee and Guardian – Estate Administration

URL: https://www.tag.nsw.gov.au/estate-administration

Non-Profit Organizations

- Financial Rights Legal Centre – Deceased Estates

URL: https://financialrights.org.au/deceased-estates - Justice Connect – Tax and Estate Planning

URL: https://justiceconnect.org.au/resources/tax-estate-planning - The Law Society of New South Wales – Estate Taxes

URL: https://www.lawsociety.com.au/legal-help/probate-estate-administration/estate-taxes - NSW Community Legal Centres – Wills and Estates

URL: https://www.clcnsw.org.au/wills-and-estates - Seniors Rights Service – Tax Obligations in Estates

URL: https://seniorsrightsservice.org.au/tax-obligations-estates