Navigating the Shifting Australian Property Market: Opportunities for Buyers in 2024

Introduction

The Australian property market is currently undergoing significant changes, with trends in property listings, pricing in picturesque towns, and the potential for buying homes with smaller deposits creating a unique landscape for buyers. Here’s a comprehensive look at how these factors are shaping opportunities in 2024.

Buyers Gain the Upper Hand as Listings Surge

Recent data from MCG Quantity Surveyors highlights a shift in market dynamics, as a surge in property listings across Australia’s top regions is creating a buyer-friendly environment. Listings have increased in 50 regions, including Bringelly-Green Valley and Rouse Hill-McGraths Hill, where they have surged over 100%. This rise in availability provides buyers, particularly first-home buyers, downsizers, and investors, with enhanced negotiating power and more choices.

Impact on Pricing: Increased listings are expected to moderate price growth, presenting strategic entry points for buyers amid economic uncertainty and rising interest rates.

Key Markets: Areas like Casey-South and Blacktown-North have seen stock increases of 74% and 53%, respectively, making these outer suburban markets more accessible for those previously priced out.

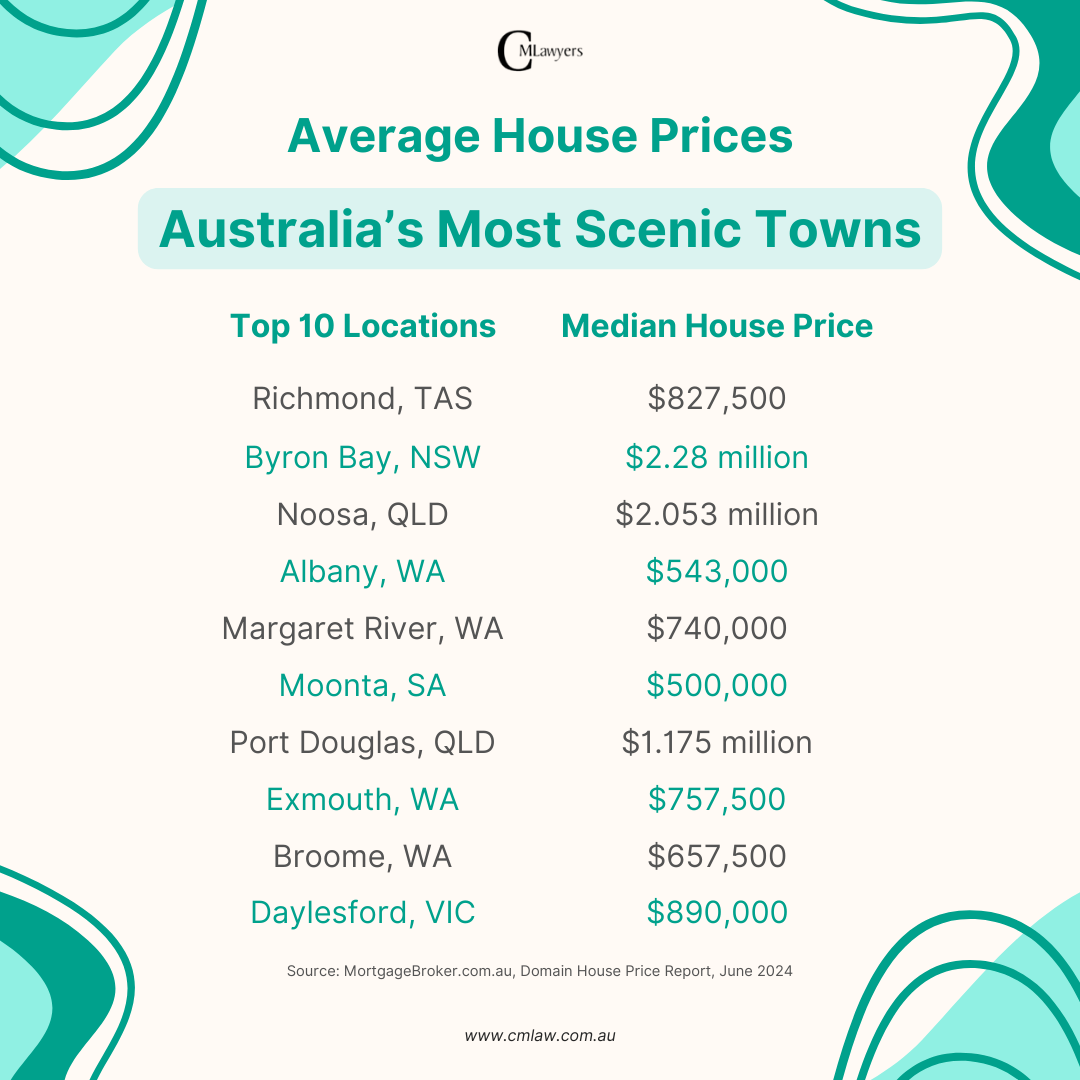

The Cost of Living in Australia’s Most Scenic Towns

Buying property in Australia’s most beautiful towns comes with a premium, driven in part by their popularity on social media platforms. These picturesque locations, from Byron Bay to Broome, boast high median house prices reflective of their desirability.

Source: MortgageBroker.com.au, Domain House Price Report, June 2024

Even Richmond, Tasmania, with its historic charm, has a median house price of $827,500, while Byron Bay, NSW, tops the list with a median of $2.28 million. These high prices highlight the financial challenge of buying in high-demand, visually stunning locations. Buyers seeking the blend of natural beauty and vibrant community often face steep entry costs.

Affordable Entry Points: Buying with Smaller Deposits

Despite rising median property prices, there are still opportunities for buyers with smaller deposits, particularly in less central locations. According to Canstar, a $50,000 deposit can secure homes in selected suburbs across major cities and regional areas.

Alternative Dwelling Options: Increasingly, buyers are turning to units and townhouses as a more accessible entry point. These smaller, attached dwellings offer a practical option for first-home buyers and downsizers looking to stay within budget.

Suburb Highlights: Suburbs like Brendale in Brisbane, Melton South in Melbourne, and Elizabeth South in Adelaide are among the locations where a $50,000 deposit could be enough to buy a house. In Sydney and Canberra, similar deposits may secure a unit rather than a house.

Strategic Considerations for Today’s Buyers

As market conditions evolve, buyers are encouraged to be strategic, focusing on timing and location to maximize their investment. The increased stock levels and the variety of entry points across different property types mean buyers can afford to be selective and negotiate harder.

Investment Potential: With opportunities ranging from more affordable suburban homes to high-value coastal properties, investors can find options that align with both their financial capabilities and long-term goals.

Timing and Market Conditions: The current abundance of listings combined with economic factors such as fluctuating interest rates suggests a potentially advantageous period for those looking to buy.

Final Thoughts: Navigating the Market with Expert Guidance

The Australian property market in 2024 presents a unique landscape for buyers. With a surge in listings shifting the market dynamics in favor of purchasers, increased affordability in certain areas, and strategic opportunities to enter picturesque and suburban locations, the current environment is ripe for those ready to take the next step. However, navigating this evolving market requires careful consideration of timing, location, and financial readiness.

While increased listings and the possibility of entering the market with smaller deposits present opportunities, buyers must remain vigilant about the potential trade-offs, such as paying lenders mortgage insurance or purchasing properties in less central locations. For those looking to invest in high-demand scenic towns or make strategic moves in suburban areas, thorough research and planning are essential.

Given the complexities of the current market, consulting with a legal expert, such as a property lawyer, can be invaluable. Legal professionals can provide guidance on contract negotiations, due diligence, and the overall purchasing process, ensuring that buyers make informed decisions and avoid common pitfalls. Engaging a legal expert early in your property journey can help safeguard your interests, streamline the buying process, and ultimately lead to a successful investment in Australia’s diverse and dynamic property market.