Cooling-Off Rights: The Crucial Period That Can Save or Cost You Thousands

What Property Buyers Need to Know About the Contract for Sale #4: What are the cooling-off period rights?

Misunderstanding cooling-off periods can result in a buyer losing their deposit if they decide to back out of the sale after the period has expired. It is essential for buyers to be aware of their cooling-off rights to make informed decisions within the allowed timeframe.

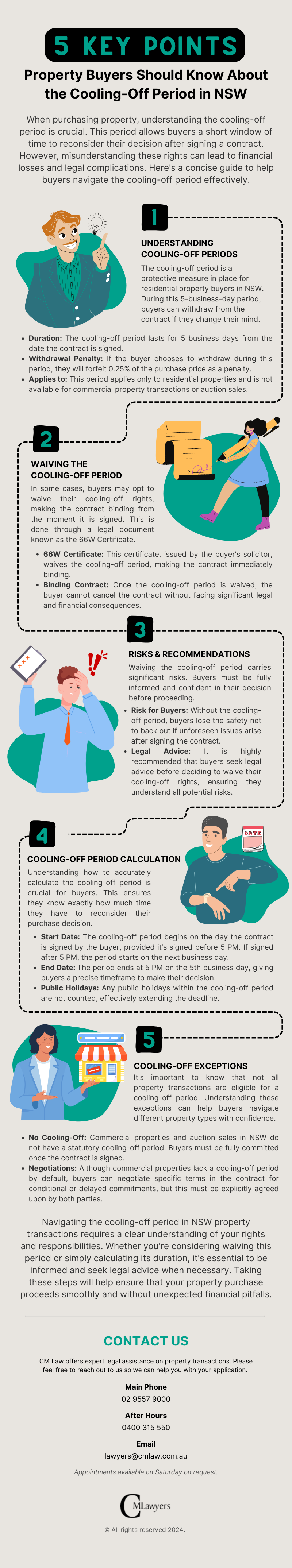

Check out this infographic for 5 key points you should know about cooling-off rights in NSW. You can also find more detailed information and a real-life court case below the infographic.

The Cooling-off Period in the Standard Contract in NSW

Clause 4 in the standard "Contract for the Sale and Purchase of Land" in New South Wales (NSW) relates to the completion of the contract. This clause typically outlines the obligations and conditions that must be met for the sale to be finalized and the property to be legally transferred to the buyer.

In New South Wales (NSW), a "66W Certificate" is a document signed by the buyer's solicitor or conveyancer that effectively waives the cooling-off period in a property transaction.

What is the Impact on the Cooling-Off Period in NSW:

- Cooling-Off Period: Normally, when a residential property is sold in NSW, the buyer has a standard 5-business-day cooling-off period after the contract is signed. During this period, the buyer can cancel the contract for any reason, although they would forfeit 0.25% of the purchase price as a penalty if they do so.

- 66W Certificate: When a 66W Certificate is provided, the buyer is waiving their right to this cooling-off period. This means that once the contract is signed and the certificate is issued, the sale is immediately binding, and the buyer cannot withdraw from the purchase without facing significant legal and financial consequences (e.g., forfeiting the deposit or being sued for damages).

When is a 66W Certificate Used in NSW?

- Competitive Market: In a competitive market, where properties sell quickly, sellers often prefer buyers who can provide a 66W Certificate because it gives them certainty that the sale will go through without delay.

- Buyer Certainty: Buyers may choose to provide a 66W Certificate to strengthen their offer, particularly if they are confident in their decision and have completed all necessary checks, such as building inspections and finance approval, before signing the contract.

Important Considerations:

- Risk for Buyers: Waiving the cooling-off period can be risky for buyers because they lose the opportunity to back out of the deal if issues arise after signing the contract. It is generally recommended that buyers only proceed with a 66W Certificate if they are fully satisfied with the property and their financial situation.

- Legal Advice: Given the significance of waiving the cooling-off period, it’s essential for buyers to seek legal advice before signing a 66W Certificate to understand the implications and ensure that they are making an informed decision.

In summary, the issuance of a 66W Certificate in NSW immediately removes the buyer's right to a cooling-off period, making the contract legally binding as soon as it is signed.

What is Clause 4 in the Contract for Sale and Purchase of Land in NSW?

These are some of the typical elements that might be covered under Clause 4 in the standard NSW contract, but it’s important to note that the actual content can vary based on the specific terms agreed upon by the buyer and seller, as well as the version of the contract used.

The exact wording and requirements of Clause 4 can vary depending on the specific version of the contract being used, but generally, it covers the following key points:

- Time and Place of Completion: The clause specifies when and where the completion (settlement) of the sale will take place. Completion is the date on which the balance of the purchase price is paid, and the property ownership is transferred to the buyer.

- Settlement Adjustments: It usually addresses how adjustments are made on the settlement date for items like council rates, water rates, and other outgoings. The buyer and seller may need to apportion these costs so that they are paid by the party who is responsible for them on the settlement date.

- Deposit: It might also touch on the handling of the deposit paid by the buyer and conditions under which it might be forfeited or returned.

- Final Inspection: The clause may give the buyer the right to inspect the property shortly before settlement to ensure it is in the same condition as when the contract was signed.

- Settlement Delays: The clause may specify the consequences of failing to complete the transaction on the agreed date, such as the imposition of penalty interest.

How Do I Calculate The Last Day of the Cooling-off Period?

To calculate the cooling-off period for a standard contract for the sale of residential property in New South Wales (NSW), you need to consider the following points:

Cooling-Off Period Duration

- Standard Length: The cooling-off period is 5 business days from the date the contract is signed by the buyer.

How to Calculate the Cooling-Off Period

- Start Date: The cooling-off period starts on the day the contract is signed by the buyer, as long as it's signed before 5:00 PM. If the contract is signed after 5:00 PM, the cooling-off period starts on the next business day.

- Count Business Days:

- Business Days: Only business days are counted. Weekends and public holidays are excluded.

- Day 1: The first business day after the contract is signed is counted as Day 1.

- End Date: The cooling-off period ends at 5:00 PM on the 5th business day.

Example Calculation

- Contract Signed on Monday: If the contract is signed on a Monday before 5:00 PM, the cooling-off period would end at 5:00 PM on the following Monday, assuming there are no public holidays during that time.

- Contract Signed on Friday: If the contract is signed on a Friday before 5:00 PM, the cooling-off period would end at 5:00 PM on the following Friday, again assuming there are no public holidays.

Special Considerations

- Public Holidays: If there is a public holiday within the 5-day period, that day is not counted, and the cooling-off period extends accordingly.

- Waiving the Cooling-Off Period: The buyer can waive the cooling-off period by providing a 66W Certificate, as discussed earlier, which makes the contract immediately binding.

Penalty for Withdrawing

- 0.25% of Purchase Price: If the buyer decides to withdraw from the contract during the cooling-off period, they will forfeit 0.25% of the purchase price as a penalty.

By following these steps, you can accurately determine the cooling-off period for a residential property contract in NSW.

The 66W Certificate is a legal document used in New South Wales (NSW) that is provided by the buyer's solicitor or conveyancer to waive the cooling-off period for the purchase of a residential property. Here’s how the 66W Certificate is enacted:

How do I go about enacting a 66w form?

Steps to Enact a 66W Certificate

- Consultation with Buyer:

- The buyer consults with their solicitor or conveyancer to discuss whether waiving the cooling-off period is appropriate for their situation. This decision is typically made after the buyer has completed all necessary due diligence, such as inspections, financing arrangements, and legal checks on the property.

- Preparation of the 66W Certificate:

- The buyer’s solicitor or conveyancer prepares the 66W Certificate. This document must be signed by the solicitor or conveyancer, not the buyer. The signature of a legal professional is necessary to ensure that the buyer has received independent legal advice and fully understands the implications of waiving the cooling-off period.

- Signing of the Contract:

- The buyer signs the contract of sale. At the time of signing, they indicate their intention to waive the cooling-off period by providing the signed 66W Certificate.

- Provision of the 66W Certificate:

- The signed 66W Certificate is then provided to the seller or the seller’s agent, typically at the same time as the signed contract of sale. This can be done in person or electronically, depending on the arrangements between the parties.

- Waiving of Cooling-Off Period:

- Once the seller receives the 66W Certificate, the cooling-off period is immediately waived. This means the contract becomes legally binding on the buyer at that moment, and they are committed to completing the purchase of the property.

Legal Effect

- Binding Contract: With the 66W Certificate in place, the contract of sale is binding, and the buyer cannot withdraw from the contract without facing serious legal consequences, such as forfeiture of the deposit or potential legal action for damages.

- No Cooling-Off Rights: The buyer no longer has the statutory right to a cooling-off period, meaning they cannot change their mind and cancel the contract without incurring penalties.

Important Considerations

- Risk: Waiving the cooling-off period is a significant decision. Buyers should only do so if they are certain about their purchase and have completed all necessary checks. The 66W Certificate effectively locks the buyer into the purchase, regardless of any issues that may arise after signing the contract.

- Legal Advice: It is crucial that buyers seek legal advice before enacting a 66W Certificate to ensure they are fully aware of the risks and consequences involved.

Enacting a 66W Certificate is a formal and legally binding process that requires careful consideration and the involvement of a legal professional to ensure that the buyer's rights and obligations are clearly understood.

Australia-wide Standard Cooling-off Periods for the Contract for Sale

| State/Territory | Cooling-Off Period Duration | Penalty for Withdrawal | Clause Number in Standard Contract | Notes |

|---|---|---|---|---|

| New South Wales (NSW) | 5 business days | 0.25% of purchase price | Clause 4 in the Contract for Sale and Purchase of Land | Applicable for private treaty sales only; no cooling-off for auction sales. |

| Queensland (QLD) | 5 business days | 0.25% of purchase price | Clause 4 in the Contract of Sale of Land | Starts on the day the buyer receives the signed contract; can be waived or shortened. |

| Victoria (VIC) | 3 business days | 0.25% of purchase price | Clause 1 in the Particulars of Sale section of the Contract of Sale of Real Estate | Applies to private treaty sales; no cooling-off for auction sales. |

| South Australia (SA) | 2 business days | 0.25% of purchase price | Clause 28 in the standard form contract | Seller must provide a Form 1 Disclosure statement before signing. |

| Western Australia (WA) | No cooling-off period | N/A | N/A | No statutory cooling-off period for residential property sales. |

| Tasmania (TAS) | No cooling-off period | N/A | N/A | No statutory cooling-off period for residential property sales. |

| Australian Capital Territory (ACT) | 5 business days | 0.25% of purchase price | Clause 4 in the Contract for Sale of Land | Applies to private treaty sales; can be waived. |

This table provides a comprehensive overview of the cooling-off periods for buying property in Australia, including the duration, penalties, clause numbers, and additional notes for clarity.

Do Cooling-off Periods Apply to Commercial Properties

No, cooling-off periods for property sales in New South Wales (NSW) do not apply to commercial properties. The standard 5-business-day cooling-off period is specifically designed for the purchase of residential properties.

Key Points:

- Residential Properties: The cooling-off period in NSW typically applies only to the sale of residential properties, such as houses, apartments, and residential land. During this period, a buyer can cancel the contract for any reason, but they will forfeit 0.25% of the purchase price as a penalty.

- Commercial Properties: For commercial properties, such as office buildings, retail spaces, warehouses, or industrial properties, there is no statutory cooling-off period. Once a contract is signed for a commercial property, it is immediately binding unless specific terms are negotiated into the contract to allow otherwise.

- Negotiated Terms: While there is no automatic cooling-off period for commercial properties, buyers and sellers can negotiate specific terms in the contract that allow for some form of conditional or delayed commitment. However, this is not standard and must be explicitly agreed upon by both parties.

- Legal Advice: It is advisable for buyers of commercial property to seek legal advice before signing a contract to ensure they fully understand the implications and to negotiate any necessary conditions upfront.

In summary, the statutory cooling-off period in NSW applies only to residential property transactions, and commercial property purchases are not afforded this protection unless specifically negotiated in the contract.

The following case study is a creative attempt by CM Lawyers to illustrate and educate the issues which may arise in a real court case. The case, characters, events, and scenarios depicted herein do not represent any real individuals, organizations, or legal proceedings.

NSW Court Case: Nguyen v. Tran [2017] NSWSC 1052

In the case of Nguyen v. Tran [2017] NSWSC 1052, the buyers, the Nguyens, misunderstood the cooling-off period and attempted to withdraw from the sale after the period had expired. This led to a legal dispute over the forfeiture of their deposit.

What Happened

The Nguyens were keen to purchase a new property but became uncertain about their decision after signing the contract. They believed they had more time to reconsider their purchase due to a misunderstanding about the cooling-off period. When they decided to back out of the sale after the cooling-off period had expired, the seller, Tran, refused to return their deposit.

Behavior of the Participants

The Nguyens, not fully understanding their cooling-off rights, acted on incorrect information. Tran, aware of the legal stipulations, insisted on retaining the deposit. The lack of clear communication and understanding of the cooling-off period led to the escalation of the dispute.

The Legal Process

The Nguyens took the matter to court, arguing that they were entitled to a refund of their deposit. The court examined the terms of the contract and the specifics of the cooling-off period. The judge ruled in favor of Tran, stating that the Nguyens had forfeited their deposit by failing to withdraw within the specified cooling-off period. This case highlighted the importance of understanding the exact duration and conditions of the cooling-off period in property contracts.

Financial Consequences

The financial consequences were significant for the Nguyens. They lost their deposit of $50,000 and incurred additional legal fees amounting to $15,000. This financial strain underscored the critical nature of being well-informed about cooling-off rights.

Conclusion

The court concluded that the Nguyens were liable for the forfeiture of their deposit due to their misunderstanding of the cooling-off period. This case serves as a crucial reminder for all property buyers to thoroughly understand their rights and the conditions of the cooling-off period.

Lessons Learned

1. Understand Cooling-Off Rights: Be fully aware of the duration and conditions of the cooling-off period in your contract.

2. Act Promptly: Make decisions within the cooling-off period to avoid financial losses.

3. Seek Clarification: Consult with your conveyancer or solicitor to ensure you understand your cooling-off rights.

4. Communicate Clearly: Ensure clear communication with the seller regarding any changes in your decision.

References

Nguyen v. Tran [2017] NSWSC 1052

NSW Fair Trading - The Sale Process

Tags and Keywords

cool off, cooled off meaning, cooling off periods in contracts, cooling off period, cool off period, contract cooling off period, cool it off meaning, cool off period meaning, cooling off period property, what is cooling off period, cooling off period meaning, define cooling off period, definition of cooling off period, cooling-off period, buying house cooling off period, cool off meaning, what happens after cooling-off period, what is the cooling off period, cooling off period australian consumer law, cooling off period auction, how long is the cooling off period, cooling off period for contracts, auction cooling off period, cooling off periods, cooling off period contract law, when does cooling off period start, when does the cooling off period start, cooling off period nsw, meaning of cooling off period, cooling off, contract law cooling off period, real estate cooling off period, cooling off period real estate, nsw cooling off period, cancel contract after cooling off period, cooling off period contract, how long is cooling off period, what happens after cooling off period, cooling-off period nsw 10 days, lease agreement cooling off period, cooling off period nsw 10 days, cancel contract after cooling-off period, cooling off period nsw deposit, cooling-off period nsw deposit, cool off howlong, cooling off period in real estate, rental contract cooling off period, does cooling off period apply to vendor, does cooling off period nsw include weekends, does the 66w waive the cooling off period, extended cooling off period, extending cooling off period, extending cooling off period because of the bank, extension of cooling off period good or bad, extensiont to cool off period s66w, house buy cooling off period deposit, house buyer cooling off period, house buying cooling off period, house contract cooling off period nsw, house contract of sale cooling off period, house cooling off period nsw, house deposit without cooling off period, house insuraance cooling off period nsw, house lease cooling off period, house offer cooling off period, house offer cooling off period fees, house purchase cooling off period nsw, house rental cooling off period, house sale contract cooling off period, house sale cooling off period, house sale cooling off period nsw, house settlement cooling off period, housing contract cooling off period, how long is cooling off period in nsw, how long is cooling-off period nsw, how long is the cooling off period in nsw, is commercial property subject to cooling off period nsw, is contract legally binding during cooling off period, 10 day cooling off period nsw, 5 day cooling off period, 66w cooling off period, australian consumer law cooling off period, cooling off period means, cooling off period on contracts, how long is cooling off period nsw, no cooling off period nsw, signed contract cooling off period, standard cooling off period nsw, what does cooling off period mean, what is cooling off period in real estate, what is cooling off period nsw, 5 day cooling off period nsw, 7 day cooling off period consumer rights, 7 day cooling off period real estate, after cooling off period, auction cooling off period nsw, australia cooling off period, buying house cooling off period nsw, buying property cooling off period, can cooling off period be waived, can seller cancel contract during cooling off period, can you back out if someone is in cooling off, can you waive cooling off period, cancel contract in cooling off period, cancelling building contract after cooling off period, consumer cooling off period, consumer law cooling off period, consumer protection act cooling off period, consumer protection cooling off period, consumer rights cooling off period, contract cooling off, contract cooling off period australia, contract cooling off period nsw, cool off definition, cool off period real estate, cooling off clause, cooling off contract, cooling off period after auction, cooling off period australia, cooling off period australian law, cooling off period consumer law, cooling off period contract of sale, cooling off period conveyancing act, cooling off period definition, cooling off period deposit, cooling off period deposit refund, cooling off period estate agents, cooling off period explained, cooling off period for business contracts, cooling off period for house, cooling off period for house purchase, cooling off period for property purchase, cooling off period for purchases, cooling off period for real estate contracts, cooling off period for seller, cooling off period for tenancy agreement, cooling off period home purchase, cooling off period house, cooling off period house contract, cooling off period house purchase, cooling off period house sale, cooling off period in nsw, cooling off period law, cooling off period legislation, cooling off period letter, cooling off period nsw contracts, cooling off period nsw conveyancing act, cooling off period nsw property, cooling off period nsw real estate, cooling off period nsw rental, cooling off period offer to purchase, cooling off period online purchases, cooling off period real estate nsw, cooling off period residential lease, cooling off period selling house, cooling off period waiver, cooling off period 中文, cooling off policy, cooling off rights, cooling off time, cooling off waiver, cooling-off period contracts australia, cooling-off period definition, deposit cooling off period, do all contracts have cooling off period, does cooling off period include weekends, does settlement include cooling off period, does the 10 day cooling off period include weekends, does the cooling off period apply to the seller, estate agent cooling off period, exclusive sale authority cooling off period, extend cooling off period nsw, fair trading cooling off period, home purchase cooling off period, house contract cooling off period, house cooling off period, how many days cooling off period, how many days is the cooling off period, is cooling off period business days, is cooling off period included in settlement, legal cooling off period, mandatory cooling off period, meaning of cooling off, no cooling off period, no cooling off period contract, nsw property cooling off period, nsw real estate cooling off period, private treaty cooling off period, property contract cooling off period, property cooling off period nsw, property purchase cooling off period, purchase cooling off period, real estate contract cooling off period, real estate cool off, real estate cooling off, real estate cooling off period nsw, real estate sale contract cooling off period nsw, real estate sale contract cooling-off period nsw, seven day cooling off period, standard cooling off period, statutory cooling off period, the cooling off period, there is no cooling off period, unconditional offer cooling off period, vendor cooling off period, waive cooling off period, waive cooling off period nsw, waiver of cooling off rights, waiving of cooling off period, what does cool off mean, what does no cooling off period mean, what is cool off, what is cooling off, what is cooling off period property, what is cooling-off period in real estate, what is the cooling off period in nsw, what is the cooling off period in real estate, what to do during cooling off period, what's cooling off period,